Not known Details About Motorcycle Insurance Cincinnati, Oh

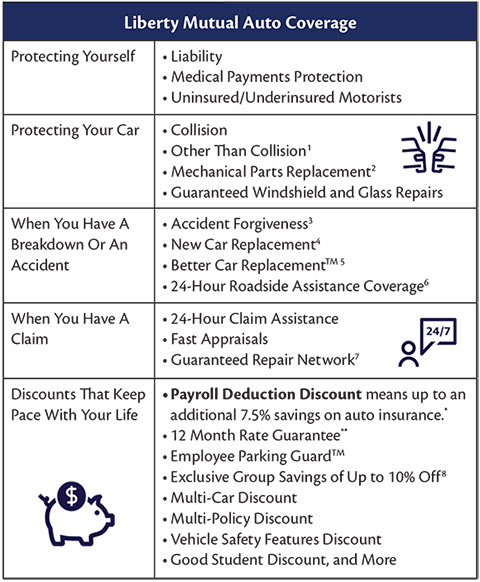

Yes, automobile insurance coverage is needed for drivers in virtually every state. A lot of drivers have auto insurance due to the fact that it is the regulation, but that does not suggest you should just acquire the minimum called for protection.

If a crash occurs, you need to know you have the best coverage to look after any residential or commercial property or bodily injury costs that may emerge. Get a cars and truck insurance policy quote online or consult with a representative today to discover just how you can aid secure on your own as well as your family. The after effects from an automobile crash can be extremely taxing and tedious.

If your vehicle is older and also its market value is low, it might not deserve it to purchase these protections. Figure out just how much you can pay for to invest out-of-pocket if your auto is damaged as well as what coverage will cost before making a decision whether it is worth purchasing to shield your automobile. Insurance Agent Cincinnati.

Some Known Incorrect Statements About Arc Insurance Motorcycle Insurance

This physical damages insurance coverage uses no matter who is at mistake in the mishap. As an example, your car obtains rear-ended while you are driving in stop and also go web traffic. Crash Insurance can help cover the expenses to repair your damaged rear bumper. Allow's state the circumstance is turned around and also you are the one who strikes somebody from behind.

Comprehensive Insurance coverage assists pay for problems done to your cars and truck in non-collision mishaps. One of the tree branches falls on your car and also dents the roof.

Usually, the vehicle insurance plan complies with the vehicle that it is covering. If you provide your cars and truck to a friend, generally, your automobile insurance would cover most of the cases that might occur while your pal is driving your cars and truck.

The Ultimate Guide To Car Insurance Cincinnati, Oh

You lend your cars and truck to a pal that requires to run a duty. Your collision insurance policy can assist cover the prices of the damages to your car.

You may additionally be held liable for home damages and also physical injury done to the various other chauffeur. In some situations, your pal's insurance might come right into play to help cover excess problems that your plan can't cover. If your pal doesn't have car insurance policy, then you will most likely be fully responsible for all harms performed in this at-fault crash.

It's also crucial to discuss that you can leave out individuals from your automobile insurance policy - Auto Insurance Cincinnati. This indicates that certain individuals will certainly not be covered by your car insurance coverage if they drive your vehicle. If someone other than you will drive your automobile routinely, look right into whether you have the proper insurance coverage.

Auto Insurance Cincinnati - The Facts

Yes, cars and truck insurance is very important for vehicle drivers who come residence for the holidays and also will be driving. You need to keep your youngsters on your insurance coverage when they go away to college, also if they will not have a vehicle with them. They will probably intend to utilize your vehicle when they get home for vacations and vacations as well as you'll intend to be sure that they have the best useful site degree of insurance coverage when driving your or any kind of other auto.

A a little older auto can sometimes cost much less to insure than a brand-new one. This is because brand-new automobiles have a higher market worth and also will generally set you back even more to website here repair or replace. Automobiles that have actually gotten on the road for a number of years might be a lot more budget-friendly to fix than new vehicles since there can be an excess of components for autos that are a couple of years of ages.

Everything about Car Insurance Cincinnati, Oh

Autos that are much more than a few years old, nonetheless, may cost more to insure. Certain vehicle makes as well as designs set you back even more to guarantee than others.

This is because the automobiles' market worths are greater and also for that reason set you back more to change or repair. Repairing a damage on a $15,000 car may be a regular work that numerous car body stores can handle. Repairing a damage on page a $90,000 automobile might require a more pricey specialized car body shop as well as result in higher fixing prices.

Commonly, SUVs as well as minivans are several of the least pricey vehicles to insure. Thieves discover some makes and also designs preferred than others. If you own an auto that frequently makes the list of frequently swiped lorries, you might need to pay a higher costs to insure it. There are other elements that have an impact on your auto insurance premiums.

Not known Incorrect Statements About Car Insurance Cincinnati, Oh

This is specifically important in the instance of big obligation claims that, without liability as well as void insurance coverage, could be financially devastating. For a little cost, you can increase the limitations of your responsibility protection significantly with umbrella protection. Find out more concerning Personal Umbrella Insurance. In the majority of states, purchasing automobile insurance coverage is called for by legislation.

Contrast Quotes From Top Companies as well as Save Secured with SHA-256 Security